This is a bilingual website

NOTE: this post was written before the current inflation rate we’re experiencing now (april 2023). Today’s high inflation rate is not due to economic growth or increase in money supply. The reasons behind it are the economy freeze generated by lockdowns/covid and the sanctions to Russia (Ukrainian war).

Inflation doesn’t scare me at all, quite the contrary.

It can be easily controlled by a state in possession of its own economic and financial policy capabilities ( unfortunately this is not the case in the single euro area countries). Do you prefer inflation and a full fridge or stable prices (stagnation) and an empty fridge? Yes, because generally economic growth and inflation go hand in hand.

All this media talking and alarming about high inflation is happening because it is not convenient for the creditor banks and holders of the debt of our (Italy) country, and beyond, to have inflation above 2%, they’re losing money, a lot of money.

On the contrary, high inflation is very convenient for a country with a big public debt like ours.

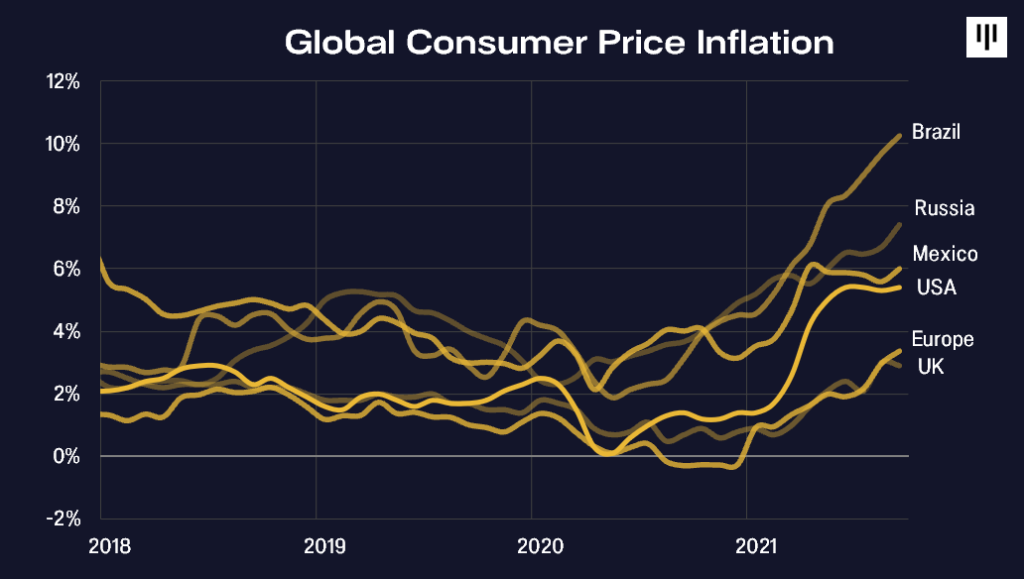

In November, the total rate of inflation touched a nearly four-decade high, and inflation for longer-lasting products hit a new high (USA)

Durable goods prices increased by 1.6% in November compared to the previous month, according to Labor Department data released on Friday.

Apart from the exceptionally high monthly price increases recorded in April, May, and June of this year, that would be an all-time high (USA)

Durable goods prices have risen 14.9% in the last 12 months, surpassing the previous high of 14.4% set in May 1975 (USA)

Trade with China, for example, has wiped out much of the United States’ furniture industry. As a result of the supply-chain challenges that have produced port congestion, shortages and higher costs are anticipated. In addition, the stimulus money provided by the Biden administration boosted demand for durable products. The spread of Delta variant illnesses slowed expenditure on services, causing more money to be spent on goods.

Inflation has set in, as any American who has purchased a carton of milk, a gallon of gas, or a secondhand car can attest. Economists are now expressing a more pessimistic outlook, predicting that higher prices will likely linger well into next year, if not longer.

Inflation in the United States is far higher than it is in Europe. Europe is experiencing the same supply shocks and supply chain challenges as the United States. However, they did not provide nearly as much stimulation.

Consumer prices are likely to rise as long as businesses can’t keep up with people’s huge demand for goods and services. Americans can keep spending money on things like lawn furniture and new cars because the job market is getting better. Employers have added 6.1 million jobs this year.

UPDATE July 2022: they managed to create inflation without economic growth. Monsters.